Best Fixed Deposits Providers in Delhi

The deposit placed by investors with companies for a fixed term carrying a prescribed rate of interest is called Company Fixed Deposit. Financial institutions and Non-Banking Finance Companies (NBFCs) also accept such deposits. Deposits thus mobilized are governed by the Companies Act under Section 58A. These deposits are unsecured, i.e., if the company defaults, the investor cannot sell the documents to recover his capital, thus making them a risky investment option

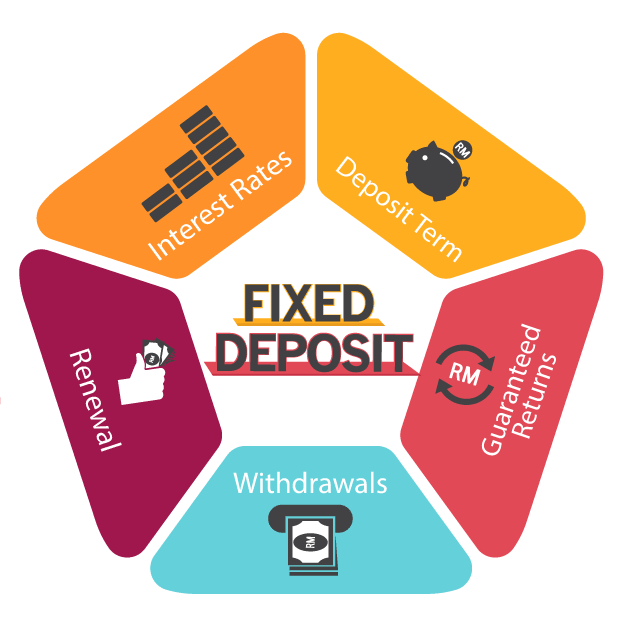

Fixed deposits or Term Deposits are a low risk savings option which earn a fixed return. Their duration can vary from 7 days to 10 years. The rate of interest for a fixed deposits also varies according to the duration of the fixed deposit, overall rates in the economy and the policy of the concerned bank. Now-a-days, fixed deposits offer a number of additional features such as sweep in facilities, loan against fixed deposit etc. A special category of fixed deposits called tax-saver FDs offer a deduction for investment up to Rs 1.5 lakh per annum.

Few of Top Fixed Deposits Lending Companies in India

HDFC Bank - HDFC Bank offers multiple fixed deposit options to their customers to park their surplus savings for a fixed tenure. A customer is required to make a deposit once into their FD account at the time of opening the account with the bank. The customer is not allowed to deposit more money and withdraw any money in the account during the tenure of the deposit. Fixed Deposits of HDFC Bank have a higher interest rate compared to their saving deposits.

ICICI Bank - ICICI Bank offers a Minimum Balance. You can avail of ICICI Bank Fixed Deposits for a minimum deposit of Rs 10,000 for General Customers and Rs 2,000 for Fixed Deposits for Minors.

Shriram Finance - It is a Deposit where the interest is paid at the time of maturity along with the Principal amount. These Deposits are accepted in multiples of Rs. 1000/- subject to a minimum amount of Rs. 5000/- per Deposit. A/c payee cheque / Demand Draft / Pay order favouring Shriram Transport Finance Company Ltd.

Punjab National Bank - PNB offers multiple fixed deposit options to their customers to park their surplus savings for a fixed tenure. A customer is required to make a deposit once into their FD account at the time of opening the account with the bank. The customer is not allowed to deposit more money and withdraw any money in the account during the tenure of the deposit. Fixed Deposits of PNB have a higher interest rate compared to their saving deposits.

Kotak Mahindra Bank - Regular Fixed Deposits. Whenever you have excess funds, the first thing you should think of is a Kotak Mahindra Regular Fixed Deposit. ... Rate is applicable for FD less than Rs. 1 crore for a tenure of 12 months 25 days as a limited period offer. 0.50% p.a.

Tata Capital - Tata Capital Financial Services Limited (TCFSL) offers a wide range of Corporate Fixed Deposits to serve conservative and moderate investors. ... In terms of returns, an investor receives comparatively better payouts than by simply investing in traditional bank fixed deposits.

DHFL - DHFL offers deposit amount in the range of Rs. 2,000 to . Rate of Interest - Interest rate is the rate charged by the bank on your fixed deposit. DHFL offers a higher rate of interest on fixed deposits of longer tenure and lower interest rate on deposits of less than a year.

Check out the lowest interest rates for Fixed Deposits in Delhi by filling in the forms and letting our intuitive algorithm search for the best deal. We work with various banks and NBFCs as compared to Fixed Deposits agents in Delhi and thus are able to search for a better offer. The entire process is completed at your doorstep or through the use of technology to make it simple and convenient. You can get the lowest interest rates for Fixed Deposits s in Delhi if you meet the eligibility criteria for various banks and NBFCs. All steps are taken in complete security and your data is always protected and secure through the entire transaction. Read all about Fixed Deposits, credit rating, EMIs and eligibility if you are wondering how to get a Fixed Deposits in Delhi. If you have your requirements ready then apply for a Fixed Deposits online by filling in our simple form or reaching out to us over phone. Instant online approval for Fixed Deposits in Delhi can also be obtained if you meet the exact criteria for a certain bank or NBFC.